sales tax rate tucson az 85713

The minimum combined 2022 sales tax rate for Tucson Arizona is. The latest sales tax rates for cities starting with A in Arizona AZ state.

/https://s3.amazonaws.com/lmbucket0/media/business/e-tucson-marketplace-blvd-s-park-ave-1SLC-1-70bKwDmK2fVPiG0sulAvuMUxNHerIs91ko7Ufc1hwR4.706b8ba63ef8.jpg)

T Mobile E Tucson Marketplace Blvd S Park Ave Tucson Az

4 beds 2 baths 1752 sq.

. 2020 rates included for use while preparing your income. The City of South Tucson primary property tax rate for Fiscal Year 2017-2018 was adopted by Mayor Council at 02487 per hundred dollar valuation. The 87 sales tax rate in Tucson consists of 56 Arizona state sales tax 05 Pima County sales tax and 26 Tucson tax.

The most populous zip code in Pima County. The Arizona sales tax rate is currently 56. The minimum combined 2022 sales tax rate for Tucson Arizona is 87.

The following are the tax rate changes effective February 1 2018 and expiring January 31 2028 Use the State of Arizona Department of Revenues Transaction Privilege. The 2018 United States Supreme Court decision in South Dakota v. Search for Product Service or Business Name.

What is the sales tax rate for the 85713 ZIP Code. Zip code 85713 is located in Tucson Arizona and has a. Arizona Department of Revenue -.

The 87 sales tax rate in Tucson consists of 56 Arizona state sales tax 05 Pima County sales tax and 26 Tucson tax. Rates include state county and city taxes. As far as all cities towns and locations go the place with the highest sales tax rate is Rillito and the place with the lowest sales tax rate is Ajo.

The Arizona state sales tax rate is 56 and the average AZ sales tax after local surtaxes is 817. The estimated 2022 sales tax rate for zip code 85713 is 870. The Tucson Arizona sales tax is 860 consisting of 560 Arizona state sales tax and 300 Tucson local sales taxesThe local sales tax consists of a 050 county sales tax and a 250.

Groceries and prescription drugs are exempt from the Arizona sales tax. There is no applicable special tax. The estimated 2022 sales tax rate for 85713 is.

The current total local sales tax rate in Tucson AZ is 8700. The sales tax jurisdiction. This includes the rates on the state county city and special levels.

The Tucson Arizona sales tax is 860 consisting of 560 Arizona state sales tax and 300 Tucson local sales taxesThe local sales tax consists of a 050 county. This is the total of state county and city sales tax rates. 656 W 44th St Tucson AZ 85713 330000 MLS 22227009 Great opportunity to own a completely remodeled Multi-Family property.

Tucson AZ 85713. The Arizona sales tax rate is currently.

New Homes For Sale In Tucson Az Home Builder Lgi Homes

Business Services Of Tucson Llc Facebook

Industrial Space For Rent Or Lease Tucson Commercial Real Estate Group Of Tucson

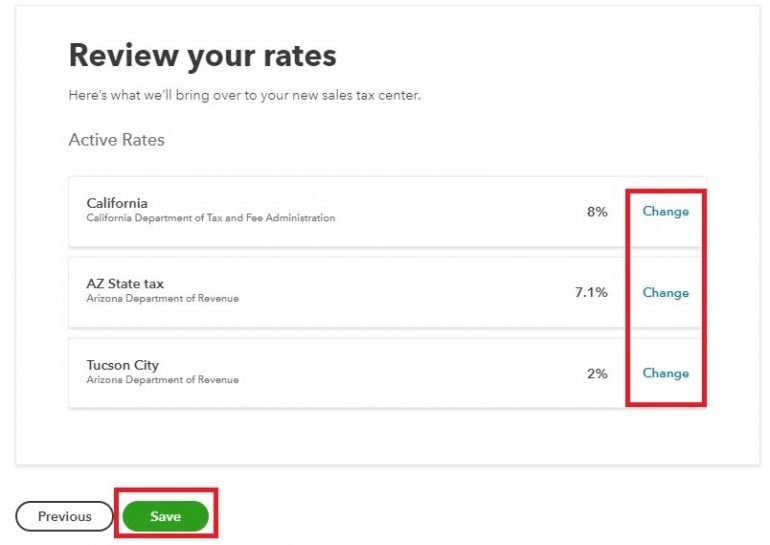

How To Run A Quickbooks Sales Tax Report Nerdwallet

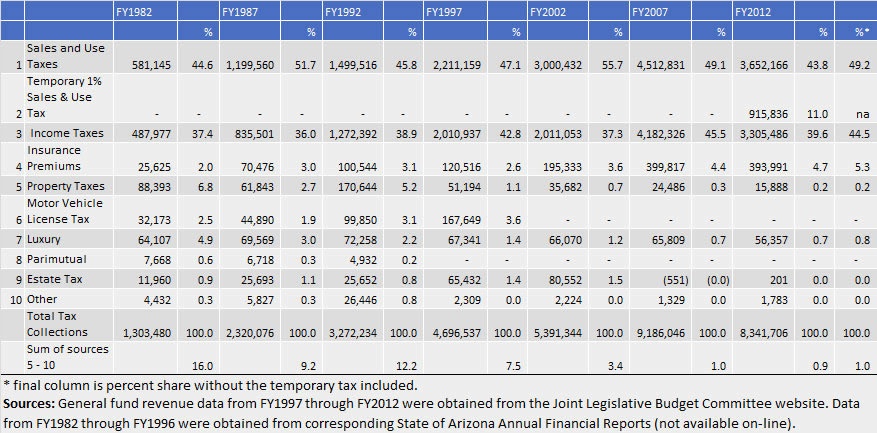

Arizona General Fund Tax Revenues An Historical Perspective Arizona S Economy

Merchants Rio Nuevo Downtown Redevelopment And Revitalization District Tucson Az

Arizona U S Small Business Administration

3456 S Liberty Ave Tucson Az 85713 Realtor Com

The Facts About Real Estate Tax In Arizona

Navajo Nation Sales Tax Nni Database

Arizona House Committee Approves State Tax Free Gun Purchases Kingman Daily Miner Kingman Az

How Much Is The Tax On Marijuana In Arizona

Prop 411 Tucson Votes To Extend Half Cent Sales Tax In Special Election The Daily Wildcat

Complete Guide To Arizona State Income Tax Payroll Taxes

Location Based Reporting Arizona Department Of Revenue

Arizona Tax Rates Rankings Arizona State Taxes Tax Foundation

Arizona Taxes Airbnb Community

Import Transactions With Sales Tax For U S Quickbooks Online Companies Saasant Blog

Tucson Arizona Sales Tax Increase For Public Safety And Road Improvements Amendment Proposition 101 May 2017 Ballotpedia